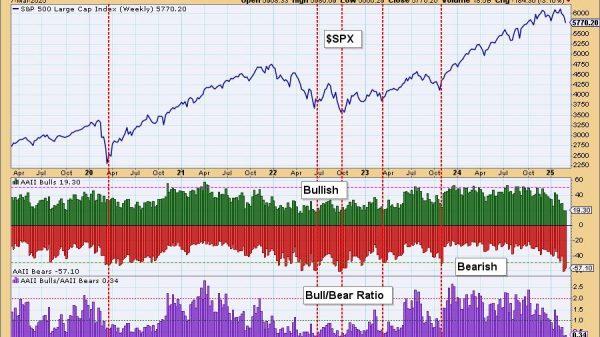

The market sell-off continued in earnest after a brief respite on Friday. Uncertainty of geopolitical tensions and tariff talk has spooked the market and given the weakness of mega-cap stocks, we are likely to see more downside before a snapback rally.

Carl was off today so Erin had the controls! She started off the trading room with a review of the DP Signal Tables to get a sense of market strength and weakness. She then analyzed indicator charts on the SPY and finished with a look at key areas of the market: Bitcoin, Dollar, Gold, Gold Miners, Yields, Bonds and Crude Oil.

After the market review Erin took a look at the Magnificent Seven daily and weekly charts. Not one of them were showing strength. Most had lost key support levels and were heading lower.

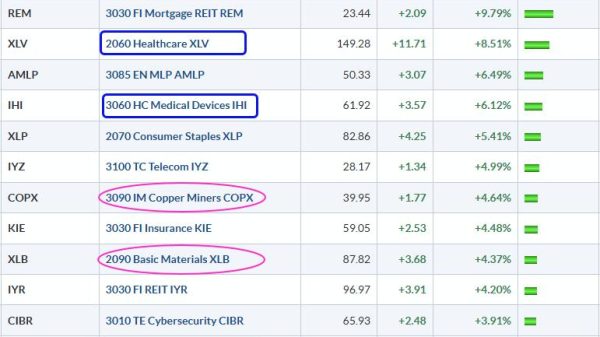

Erin then walked us through sector rotation. It is clear that the defensive sectors of the market are leading the way with the exception of Utilities which have been in a declining trend. Erin dove into the Energy sector, looking under the hood to determine if the current rally will continue.

She finished the trading room with a review of viewer symbol requests that included: PAYC, VLO and LLY among others.

Don’t forget that you can join us live in the trading room by registering once at this link: https://zoom.us/webinar/register/WN_D6iAp-C1S6SebVpQIYcC6g#/registration

We love doing the trading room, but we do have to make a living! Come try out any of our subscriptions for two weeks free with our trial coupon code: DPTRIAL2. You’ll find our subscriptions here: https://www.decisionpoint.com/products.html

01:21 DP Signal Tables

04:44 Market Analysis

18:05 Questions

21:47 Magnificent Seven

32:39 Sector Rotation

38:08 Symbol Requests

The DP Alert: Your First Stop to a Great Trade!

Before you trade any stock or ETF, you need to know the trend and condition of the market. The DP Alert gives you all you need to know with an executive summary of the market’s current trend and condition. It not only covers the market! We look at Bitcoin, Yields, Bonds, Gold, the Dollar, Gold Miners and Crude Oil! Only $50/month! Or, use our free trial to try it out for two weeks using coupon code: DPTRIAL2. Click HERE to subscribe NOW!

Learn more about DecisionPoint.com:

Watch the latest episode of the DecisionPointTrading Room on DP’s YouTube channel here!

Try us out for two weeks with a trial subscription!

Use coupon code: DPTRIAL2 Subscribe HERE!

Technical Analysis is a windsock, not a crystal ball. –Carl Swenlin

(c) Copyright 2025 DecisionPoint.com

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.

Helpful DecisionPoint Links:

Price Momentum Oscillator (PMO)