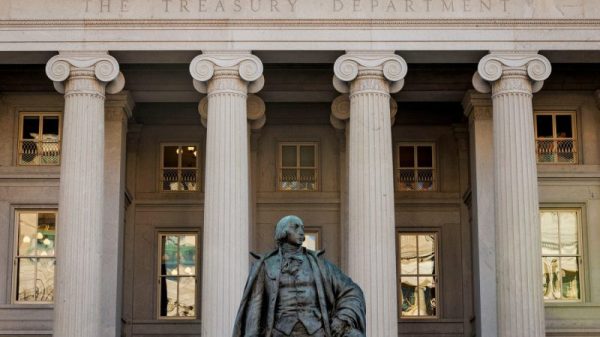

The U.S. Department of the Treasury on Sunday announced it won’t enforce the penalties or fines associated with the Biden-era “beneficial ownership information,” or BOI, reporting requirements for millions of domestic businesses.

Enacted via the Corporate Transparency Act in 2021 to fight illicit finance and shell company formation, BOI reporting requires small businesses to identify who directly or indirectly owns or controls the company to the Treasury’s Financial Crimes Enforcement Network, known as FinCEN.

After previous court delays, the Treasury in late February set a March 21 deadline to comply or risk civil penalties of up to $591 a day, adjusted for inflation, or criminal fines of up to $10,000 and up to two years in prison. The reporting requirements could apply to roughly 32.6 million businesses, according to federal estimates.

The rule was enacted to “make it harder for bad actors to hide or benefit from their ill-gotten gains through shell companies or other opaque ownership structures,” according to FinCEN.

In addition to not enforcing BOI penalties and fines, the Treasury said it would issue a proposed regulation to apply the rule to foreign reporting companies only.

President Donald Trump praised the news in a Truth Social post on Sunday night, describing the reporting rule as “outrageous and invasive” and “an absolute disaster” for small businesses.

Other experts say the Treasury’s decision could have ramifications for national security.

“This decision threatens to make the United States a magnet for foreign criminals, from drug cartels to fraudsters to terrorist organizations,” Scott Greytak, director of advocacy for the anticorruption organization Transparency International U.S., said in a statement.

— Greg Iacurci contributed to this article.